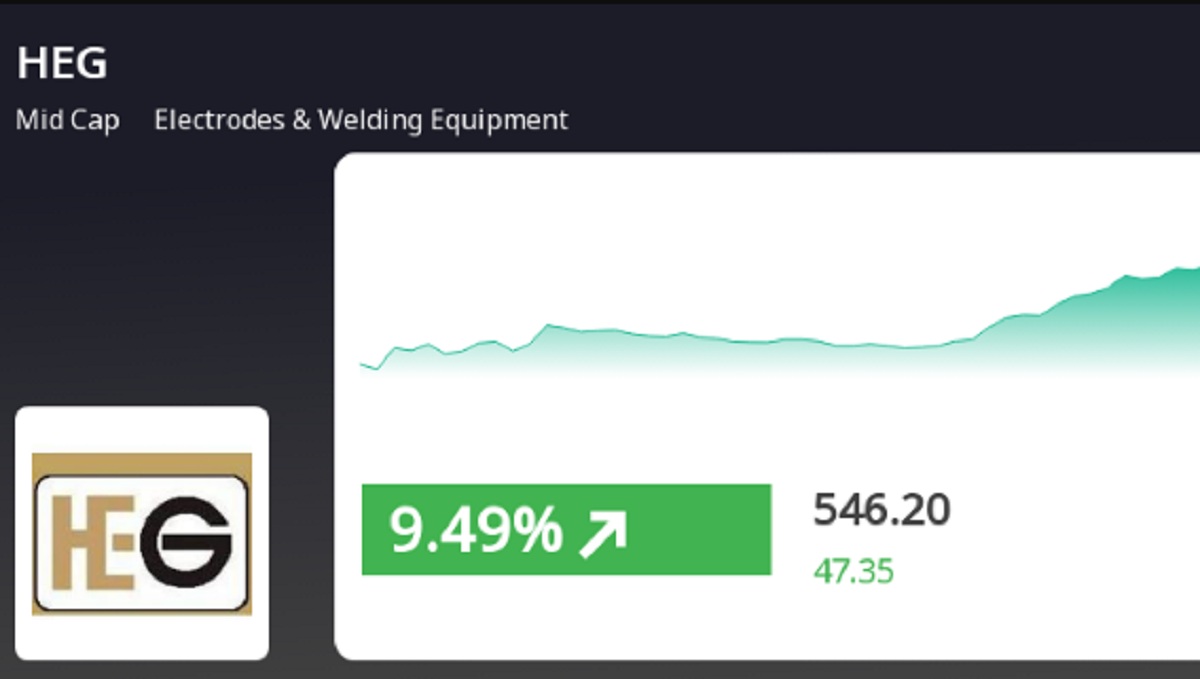

HEG, a midcap company in the electrodes and welding equipment sector, continues its upward trajectory in the stock market. On December 4, 2024, the company’s stock rose by 6.68%, outperforming the sector average by 0.77%. This marks the second consecutive day of gains, with a remarkable 17.23% increase over two days.

The stock reached an intraday high of 522.25, reflecting a 4.69% rise. Currently, HEG is trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, signaling a robust bullish trend.

Analyst Insights

According to MarketsMOJO, a trusted stock analysis platform, the recommendation for HEG is a ‘Hold.’ This assessment is based on the stock’s recent performance and market trends, offering a neutral stance without bias from investor sentiment or expert speculation.

Market Comparison

HEG has significantly outperformed the broader market, surpassing the Sensex by 7.13% in a single day and 25.02% over the past month. This highlights the company’s strong growth potential and resilience in its industry.

Looking Ahead

HEG’s stock performance reflects the company’s strategic efforts to maintain its market leadership in the electrodes and welding equipment sector. With a ‘Hold’ rating from analysts, investors are encouraged to monitor the stock closely and make informed decisions based on its performance and evolving market conditions.