Bank of America Global Research now expects the U.S. Federal Reserve to cut interest rates by 25 basis points in December, citing weakening labor market data and a series of dovish signals from senior policymakers. The shift marks a notable change from BofA’s earlier forecast, which predicted that the Federal Open Market Committee (FOMC) would hold rates steady at its final meeting of 2025.

The updated outlook, released Monday, also includes expectations for two additional rate cuts in June and July 2026, which would bring the federal funds rate to a terminal range of 3.00%–3.25%.

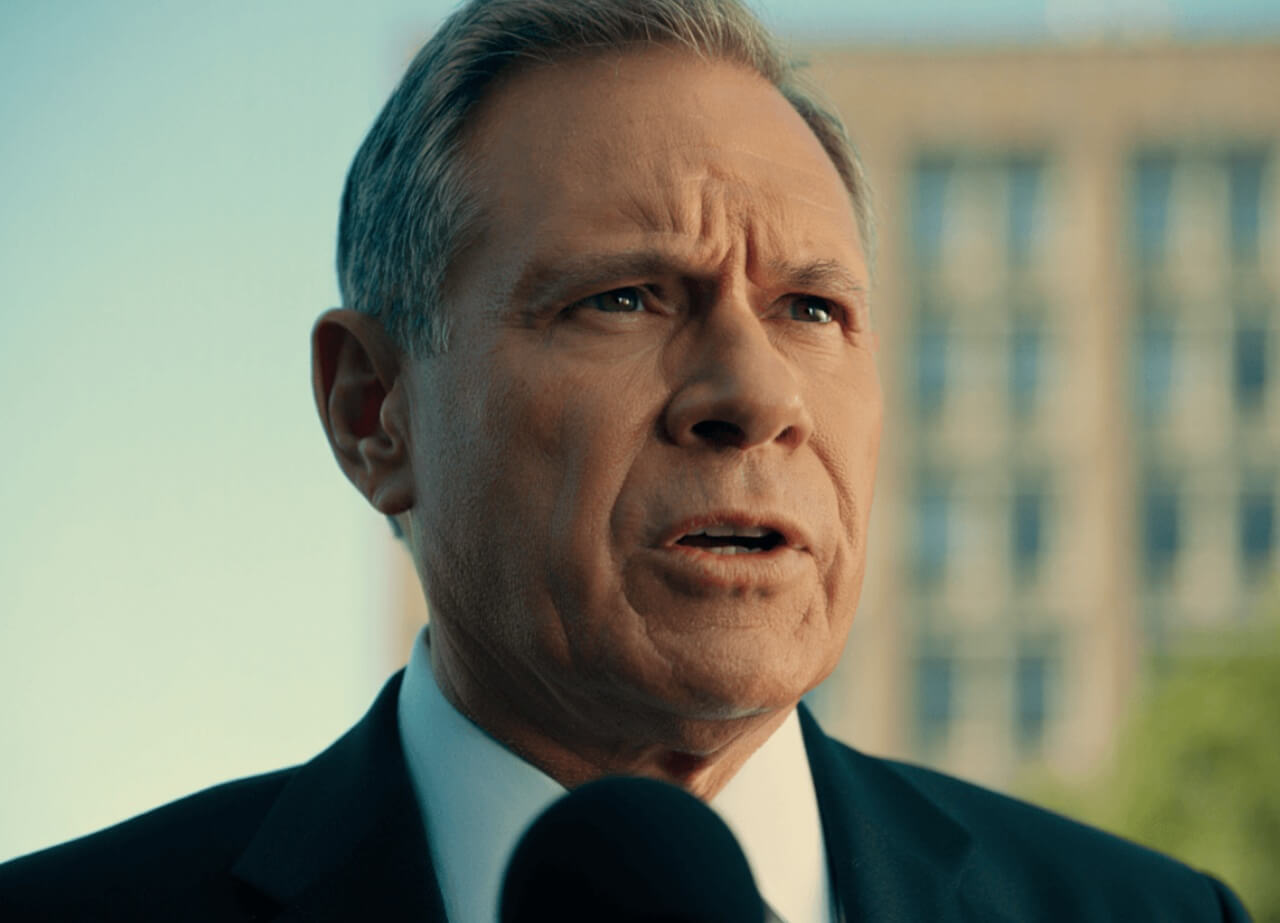

According to BofA analysts, the decision is influenced not only by economic indicators but also by anticipated leadership changes at the central bank. White House economic adviser Kevin Hassett has reportedly emerged as the leading candidate to replace Jerome Powell as the next Federal Reserve Chair, a development that could shift the Fed’s policy tone.

Weaker Job Market, Softer Tone from Fed Officials

BofA’s revised projection follows dovish remarks from influential policymakers, including New York Fed President and FOMC Vice Chair John Williams, who recently hinted at increased willingness to begin easing policy sooner than previously expected.

The analysts cautioned that moving too quickly could risk easing monetary policy excessively just as the effects of new fiscal spending begin to take hold.

“By cutting rates next week, we think the Fed would increase the risk of pushing policy into accommodative territory, just as fiscal stimulus kicks in,” BofA said in its note.

Markets Already Pricing In December Cut

Financial markets appear aligned with expectations for a cut. Traders are pricing in an 87.6% probability of a quarter-point reduction this month, according to the CME FedWatch Tool.

Most major brokerages—including Morgan Stanley and Standard Chartered—now anticipate a 25 bps cut at the December meeting. However, a smaller group of analysts expect the Fed to hold rates steady until more definitive labor and inflation data emerges.

Upcoming Decision Will Set Tone for 2026

The December 9–10 policy meeting is expected to be one of the most closely watched of the year, setting the trajectory for borrowing costs, mortgage rates, corporate lending, and financial markets heading into 2026.

Fed leaders continue to walk a delicate line as inflation cools but remains above the 2% target, while job growth slows and economic momentum shows uneven performance across sectors.

A pivot to rate cutting would signal a significant shift in the Fed’s year-long battle to restrain prices without triggering a recession.