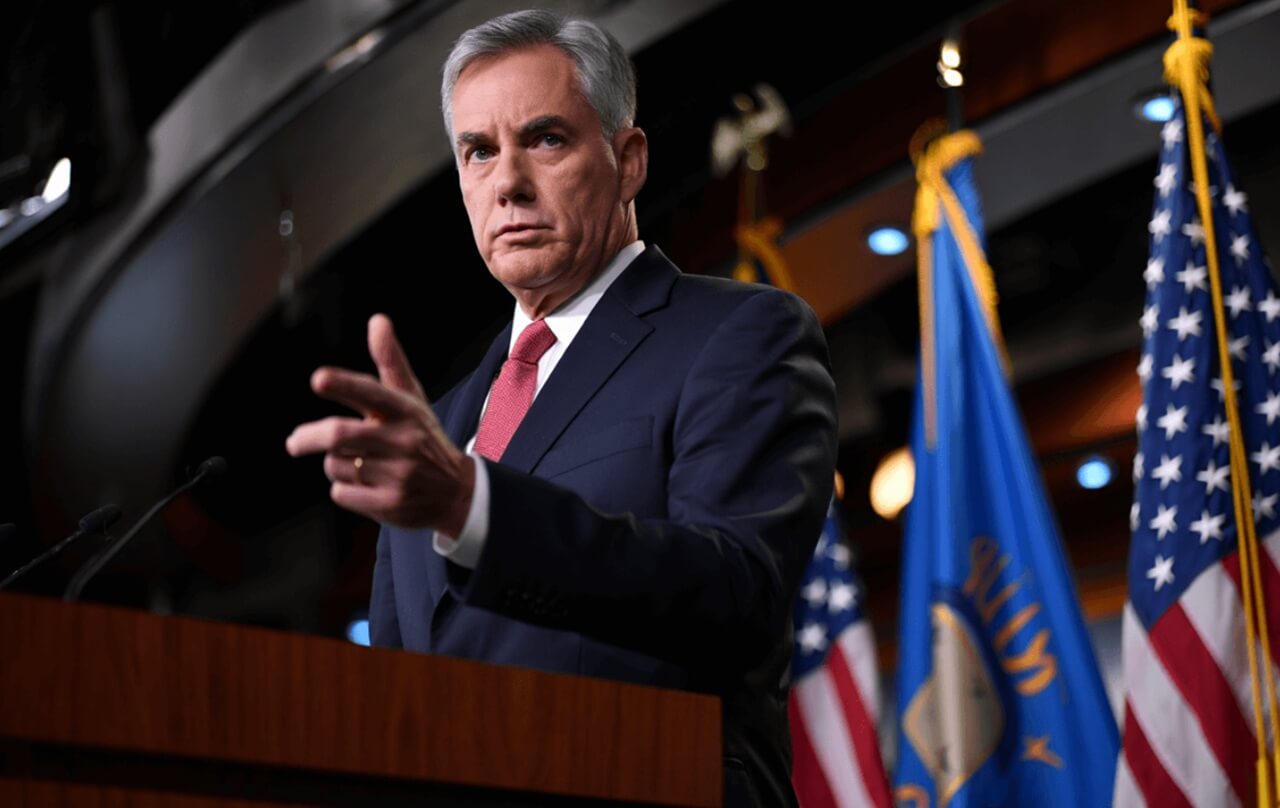

Investor and television personality Kevin O’Leary has made a decisive move in his cryptocurrency strategy, selling off all digital assets in his portfolio except Bitcoin and Ethereum. The shift comes as U.S. lawmakers move closer to regulatory clarity, a development O’Leary believes will fundamentally reshape how institutions invest in crypto.

Often referred to as “Mr. Wonderful,” O’Leary said the decision reflects a growing institutional consensus that only a small number of digital assets will survive tighter oversight. In his view, Bitcoin and Ethereum have already crossed that threshold.

Why O’Leary Cut All Altcoins

O’Leary argues that most altcoins lack the regulatory clarity, liquidity, and infrastructure required for long-term institutional adoption. As compliance rules tighten, he expects capital to consolidate around assets that regulators and professional investors can clearly categorize.

According to O’Leary, Bitcoin and Ethereum together capture the vast majority of crypto market “alpha” without exposing investors to excessive risk. He has capped his Bitcoin exposure at under 5% of his total portfolio, a level he compares to traditional allocations in gold.

“There are many interesting coins,” O’Leary has said in recent interviews, “but institutions want defensible assets.” In his view, most alternative tokens will struggle to meet that standard.

The CLARITY Act as a Turning Point

Central to O’Leary’s timing is the Digital Asset Market CLARITY Act, passed by the U.S. House in July 2025 with broad bipartisan support. The legislation establishes clearer oversight of crypto markets, giving the Commodity Futures Trading Commission (CFTC) a key regulatory role while preserving the SEC’s authority over certain transactions.

O’Leary believes this framework is exactly what large allocators have been waiting for. Once finalized, he expects institutions to evaluate digital assets the same way they assess commodities or currencies—based on liquidity, volatility, and yield potential.

By those measures, he argues, Bitcoin and Ethereum stand apart. Most altcoins, he says, will fail to qualify.

Bitcoin’s “Graduation” to Institutional Asset

O’Leary has also said that Bitcoin has effectively “graduated” into a permanent place in institutional portfolios. After more than 16 years of non-zero performance, he compares it to an early-stage commodity with enough history to support professional analysis.

Rather than debating Bitcoin’s legitimacy, institutions are now asking where it fits within diversified portfolios. O’Leary believes that shift marks a major milestone for crypto adoption.

Betting on Infrastructure, Not Just Tokens

Notably, O’Leary says his strongest crypto-related returns are not coming from Bitcoin itself. A significant portion of his portfolio is invested in crypto infrastructure, including exchanges, mining operations, and data-center businesses that support blockchain networks.

He describes this as a “picks and shovels” strategy, noting that these companies benefit from both crypto growth and rising demand for computing power driven by artificial intelligence. His infrastructure holdings currently outperform his direct crypto positions.

What It Means for Investors

O’Leary’s move highlights a more conservative approach to digital assets as regulation tightens. Rather than chasing speculative tokens, he favors limited exposure to established assets and a broader focus on the businesses that power the ecosystem.

As the CLARITY Act advances, his strategy suggests a future where crypto markets become more concentrated—and where discipline may matter more than hype.