The Federal Reserve has cut its benchmark interest rate by 25 basis points, bringing the federal funds rate to a range of 3.75%–4.00%. This marks the second consecutive cut since September and reflects the Fed’s strategy to stimulate borrowing amid signs of economic cooling. The move, announced on October 29, 2025, is expected to make key financial products more affordable for consumers and businesses.

Experts anticipate another rate cut in December, which could further ease credit conditions heading into 2026.

The Federal Reserve reduced the federal funds rate by 0.25% on October 29, 2025, during its FOMC meeting in Washington, D.C.. The cut aims to stimulate borrowing and spending amid a slowing labor market and persistent inflation concerns. The rate now stands at 3.75%–4.00%, and consumers will see lower costs on mortgages, HELOCs, and personal loans, while savings yields may decline.

Products That May Get Cheaper

- Mortgages: 15- and 30-year mortgage rates are expected to drop further, offering relief to homebuyers and refinancers.

- HELOCs: Variable-rate home equity lines of credit will adjust downward, reducing monthly payments for borrowers.

- Personal Loans: Average rates may fall from 12.25% to near 10%, making unsecured borrowing more attractive for debt consolidation and emergencies.

These changes could take effect within weeks, depending on lender response times.

Quotes and Reactions

Michele Raneri, VP at TransUnion, said:

“Even modest rate cuts can have meaningful consequences for consumer behavior and financial health”.

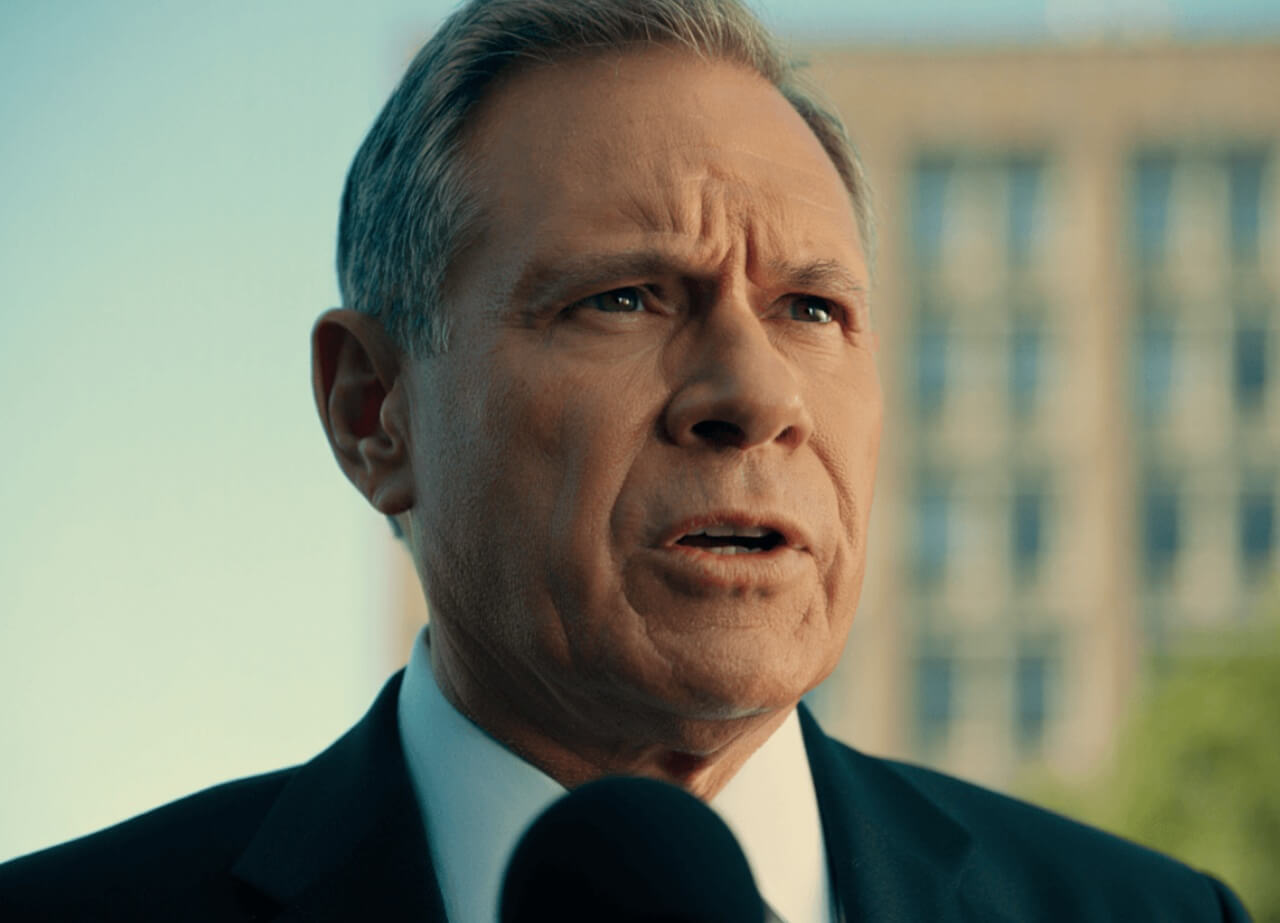

Federal Reserve Chair Jerome Powell stated:

“We remain committed to supporting economic stability and will adjust policy as needed”.

Borrowers vs. Savers

While borrowers benefit from lower interest rates, savers may see reduced returns on high-yield savings accounts and CDs. The Fed’s move is expected to boost consumer spending, encourage home purchases, and support small business lending. However, analysts caution that inflation and labor market trends will determine future rate decisions.

What’s Next: December Rate Outlook

- Next FOMC Meeting: December 17–18, 2025

- Expected Action: Potential third rate cut

- Consumer Advice:

- Refinance mortgages before rates rebound

- Compare HELOC and personal loan offers

- Monitor savings account yields

Borrowers with strong credit scores will continue to qualify for the best terms.